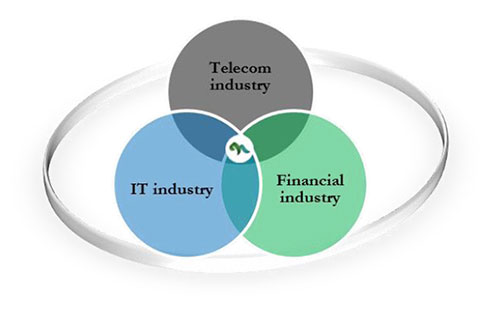

New service platforms are deteriorating telecom operators’ position in the value chain and pushing them to become merely “electricity providers” in high margin telecom service market. Banks in the financial service industry are facing almost inevitably the same faith. New independent platforms are changing the way we do financial services. As Brett King puts it, “banking is no longer somewhere you go, but something you do.” The fast pace of new innovative services developed by new players, boosted by disruptive innovations, are growing independent from banks and making banks merely clearing house for advanced and more customized financial service platforms. The IT industry on the other hand is spreading its reach both to telecom and financial industries.

These three major industries; telecom, financial and IT are merging together. This fundamental shift is changing all three industries radically. Never have there been so many disruptive technologies around than today. We will see old structures breaking down and many new players emerging as global players.

Revolution in your pocket

Mobile is providing a major opportunity to improve existing services and create new once. It gives you the option to buy, when and where the decision to buy has been made. It can guide you to get to any location and allows you to compare offerings between online and offline stores. Furthermore, it provides you access to financial services, wherever you are. And if you ever doubt your decision to buy, you can always ask feedback from your trusted friends through social media.

While mobile has truly become a central piece for consumers in developed countries, banks have been very hesitant to pursuit their mobile strategy further than creating mobile friendly online banking site or application. Even worse, they have refused to open 3rd parties access to banking platform and paralyzed innovation for a decade.

Meanwhile, mobile operators have been opening mobile financial services in emerging markets at a furious speed. The mobile phone is already ‘the device’ also for people at the bottom of the pyramid, which is decreasing poverty and providing access to financial services. Just to name a few, transfer money, pay bills, buy airtime top-up, microfinance and sent money abroad. In fact, a poor African country, Kenya, is the world market leader in mobile money services – every second person who sends money over a cell phone is a Kenyan. What happened in Europe, North America and other developed countries? Japan is the only developed country, which has had a wide mobile wallet usage since 2004.

Time of incremental innovation in financial service industry is over

The past decade banks have been trying to shine their image by providing incremental innovation, which have contributed very little to their private customers. At the same time corporate bank customers have been enjoying even less service innovation. If you compare bank innovation performance against their future competitors, such as Google, Apple, Amazon, PayPal and others, it becomes clear that new players are far ahead and very well positioned to

gain a lion share of financial markets in coming years.

Considering that the European financial industry alone contributes a total value of €24Bn, whereas advertising market total value in Europe is “only” $4Bn, financial service industry is the most attractive market for any multinational and innovative SME.

Drivers to capture this huge potential

- Be Social: Provide ability to connect with friends, colleagues and experts and get recommendations from trusted network

- Be Collaborative: Allow to collect funds for good cause, save money or invest together (e.g. crowd funding, microloans, project funding)

- Be Facilitator: Position yourselves to become key facilitator for new services and business. Create open and interoperable platform approach without dependence towards banks and operators.

- Be Mobile: Ability to use with any device, but special attention should be put on mobile and tablet as central devices to facilitate new business and services (or improve existing once)

- Be Open towards 3rd parties: Open your platform towards 3rd parties and boost your ecosystem and usage with extensive service portfolio

- Be transparent and give recommendation via superior dashboard: Provide full visibility for cash flow and risks. Provide recommendations from opinion leaders or allow to request professional recommendation based on automated tools (personal financial management)